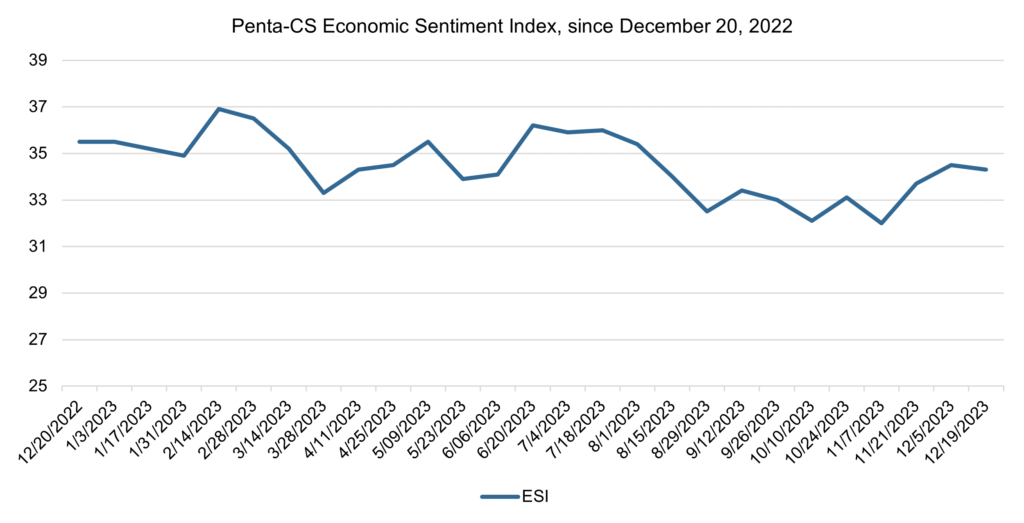

Economic sentiment declined over the last two weeks. The Penta-CivicScience Economic Sentiment Index (ESI) decreased 0.2 points to 34.3.

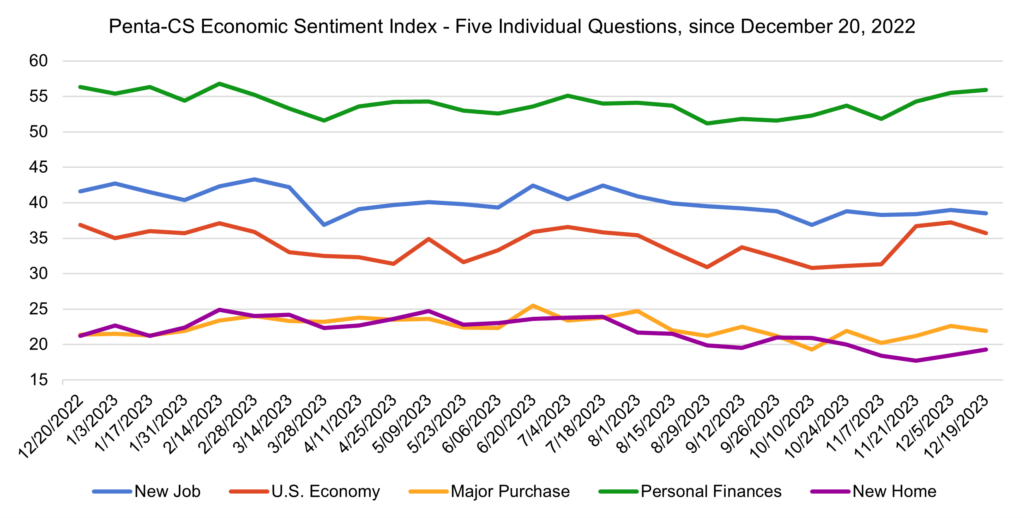

Three of the five ESI indicators decreased over the past two weeks. Confidence in the overall U.S. economy fell the most, dropping 1.5 points to 35.7.

—Confidence in making a major purchase fell 0.7 points to 21.9.

—Confidence in finding a new job fell 0.5 points to 38.5.

—Confidence in personal finances rose 0.4 points to 55.9.

—Confidence in buying a new home rose 0.8 points to 19.3.

The Fed maintained the target federal funds rate at 5.25%-5.5% on December 13—the third time in a row the Fed held the rate steady. Meanwhile, Federal Chair Jerome Powell noted that “we believe that our policy rate is likely at or near its peak for this tightening cycle,” indicating that rate cuts may occur next year. After the Fed’s announcement, the Dow surged by over 400 points, exceeding the 37,000 for the first time.

The decision to hold rates steady coincides with a report from the Congressional Budget Office showing the U.S. economy is set to avoid a recession. The report projects the economy will grow 1.5% in 2024. However, it also expects unemployment to increase to 4.4% by the end of 2024 and to remain near that level through 2025.

The Labor Department reported that 199,000 jobs were added to the economy in November, although that number is bolstered by tens of thousands of autoworkers and actors who returned to work after strikes. Additionally, the unemployment rate dropped from 3.9% to 3.7%, and wages increased 0.4% throughout November.

Mortgage rates have declined for seven consecutive weeks, falling below 7% for the first time since mid-August the week of December 14. Along with the mortgage rate decreases, mortgage applications have been increasing, rising for a sixth straight week for the week ending December 8 according to the Mortgage Bankers Association, an indicator that demand may be rising.

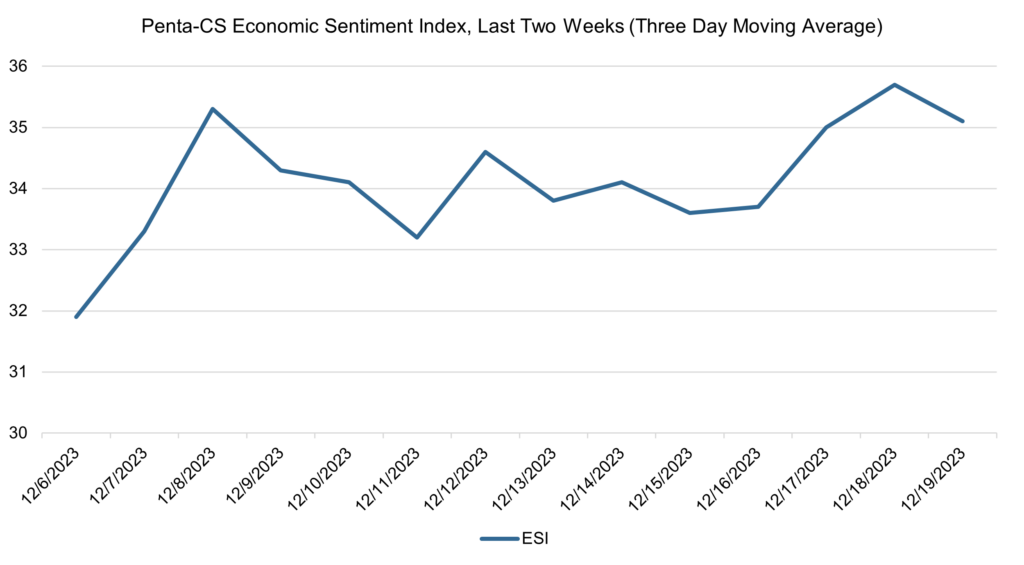

The ESI’s three-day moving average began this two-week stretch at 31.9 on December 6. It then rose to 35.3 on December 8 before trending downward to 33.2 on December 11. The three-day average then oscillated between increasing and decreasing before rising to a peak of 35.7 on December 18. The three-day average then fell slightly to 35.1 close out the session.

The next release of the ESI will be Wednesday, January 3, 2023.