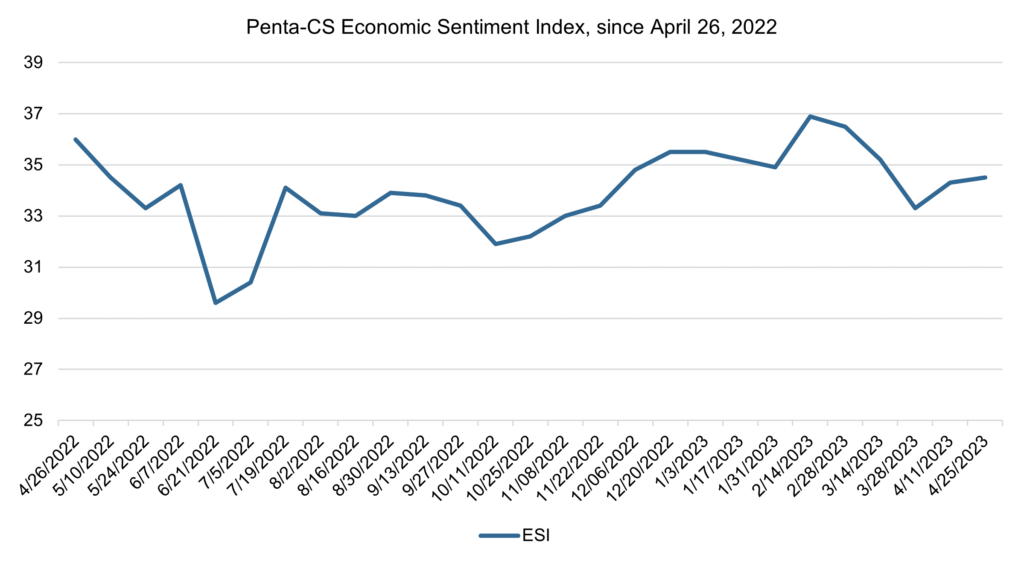

Economic sentiment slightly increased over the past two weeks, the first increase in sentiment in back-to-back readings this year. The Penta-CivicScience Economic Sentiment Index (ESI) rose 0.2 points to 34.5.

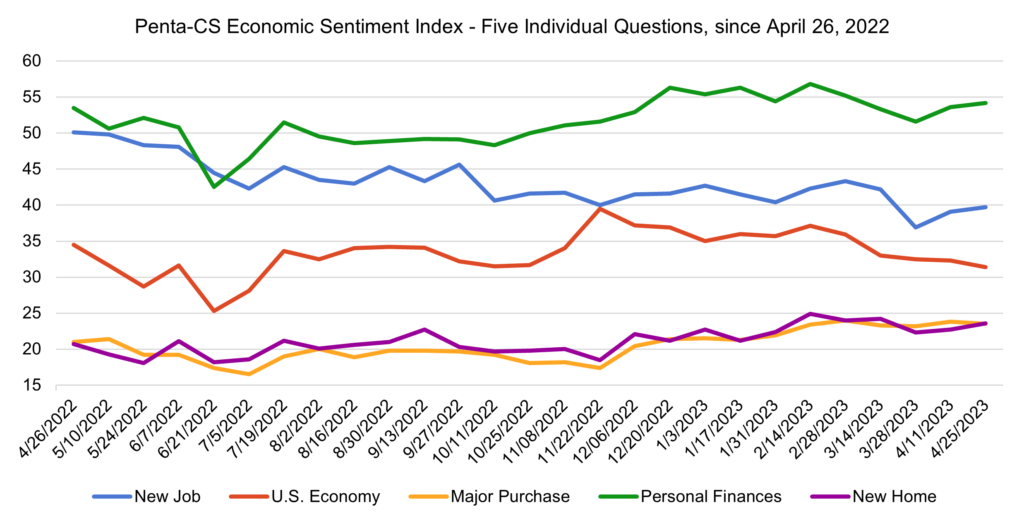

Three of the ESI’s five indicators increased over the past two weeks. Confidence in buying a new home grew the most, rising 0.9 points to 23.6.

—Confidence in personal finances rose 0.6 points to 54.2.

—Confidence in finding a new job rose 0.6 points to 39.7.

—Confidence in the overall U.S. economy fell 0.9 points to 31.4.

—Confidence in making a major purchase fell 0.3 points to 23.5.

Confidence in buying a new home rose despite home sales falling across the U.S. in March, decreasing 2.4% from the prior month to a seasonally adjusted annual rate of $4.44 million. The slowdown is starting to impact prices—the national median existing-home price had its biggest year-over-year price drop since January 2012, declining 0.9% in March from a year earlier to $375,700, and median prices were down 9.2% from a record $413,800 in June. Although prices have decreased some experts still predict home sales to rise, including Zillow, which is predicting a 1.7% increase in U.S. home values between March 2023 and March 2024.

Initial claims for unemployment rose to a seasonally adjusted 245,000 the week ending April 22, up from the previous week’s 240,000, but still within the range that claims were in the years before the pandemic. The weekly claims numbers help show that Americans are still enjoying a relatively strong labor market, despite broader economic uncertainty.

As earnings reporting season kicks off, some of the world’s largest companies will soon report their earnings, which has caused some on Wall Street to be at a standstill until the reports come out. While the major stock indices remained relatively stable over the week leading up to April 24, U.S. Treasury yields declined on April 24 as investors considered the future of the U.S. economy after data released last week was mixed with positive and negative signs.

These shifts come alongside a pivotal vote to resolve the debt ceiling standoff on Capitol Hill. House Democrats and Republicans are currently at an impasse, and some experts on Wall Street have begun to question the risk of default if the two parties cannot come to an agreement. The exact “X date” for the government defaulting on its debt is still unknown, but the Congressional Budget Office projects that it will occur sometime between July and September 2023. However, weaker-than-expected tax receipts for the April filing could pull that deadline forward.

Experts are attributing a decline in consumer spending to what’s being called a “freight recession” in the U.S. economy, as warehouses report less trucking traffic and a 40% decrease in manufacturing orders. UPS’ earnings statement reflected this economic slowdown, with the company’s CEO saying the fast decrease in sales volume “caused us pause.”

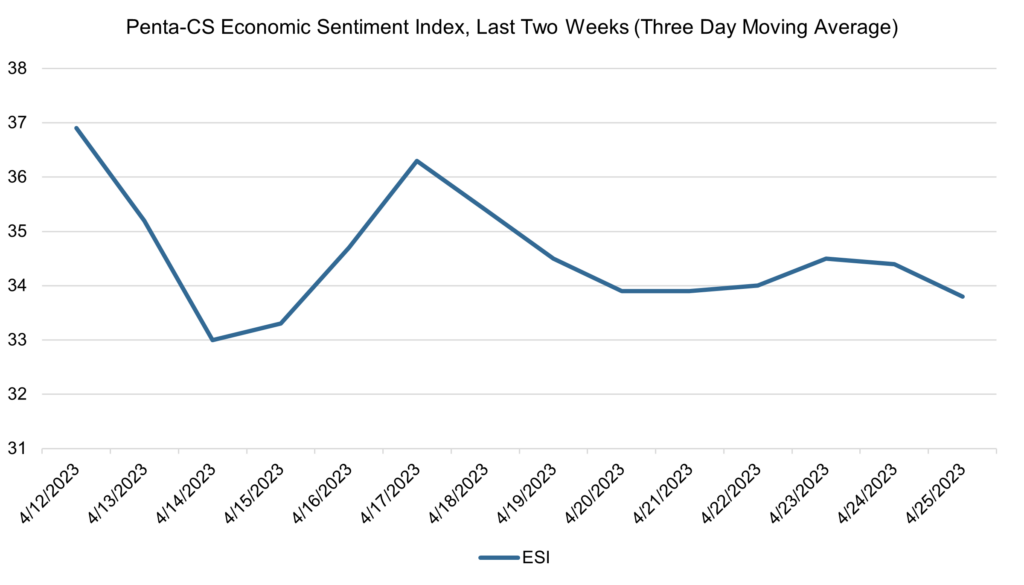

The ESI’s three-day moving average began this two-week stretch at a peak of 36.9 on April 12. It then trended downward to a low of 33.0 on April 14, before rising to 36.3 on April 17. The three-day average then fell to 33.9 on April 20 and 21, rose to 34.5 on April 23, and then fell to 33.8 on April 25 to close out the session.

The next release of the ESI will be Wednesday, May 10, 2023.