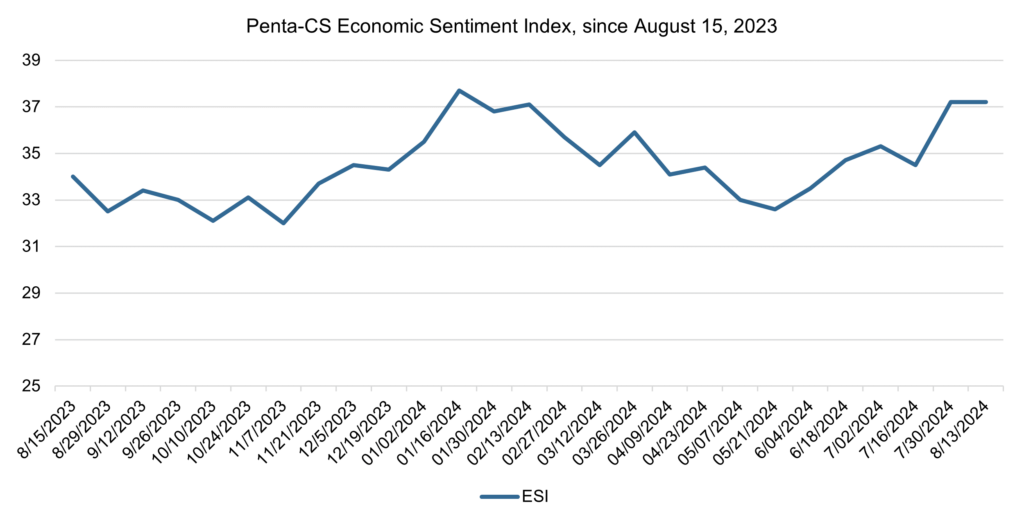

Economic sentiment holds steady after last period’s large increase

The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) remained flat at 37.2 following last period’s large increase.

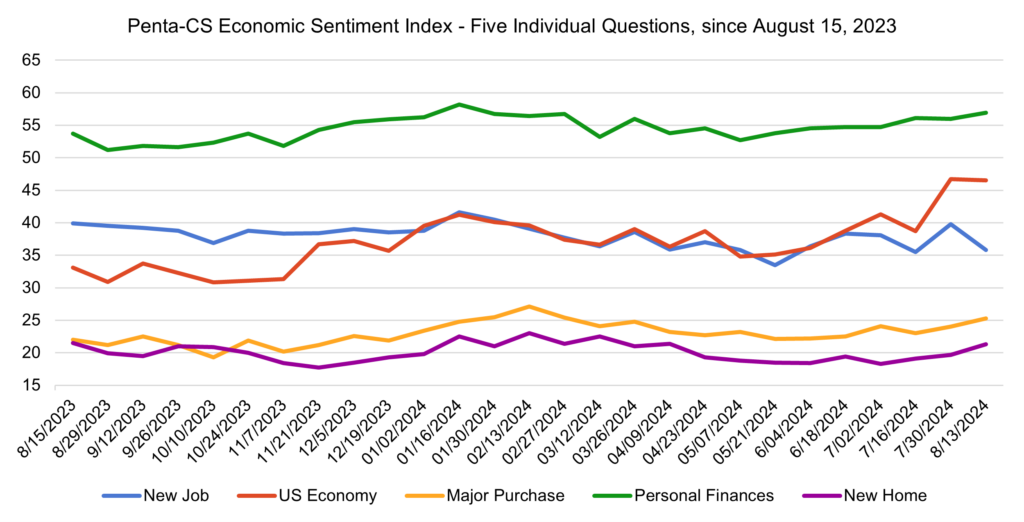

Three of the ESI’s five indicators increased over the past two weeks. Confidence in buying a new home increased the most, rising 1.6 points to 21.3.

—Confidence in making a major purchase increased 1.3 points to 25.3.

—Confidence in personal finances increased 0.9 points to 56.9.

—Confidence in the overall U.S. economy decreased 0.2 points to 46.5.

—Confidence in finding a new job decreased 4.0 points to 35.8.

The July Jobs Report from the Bureau of Labor Statistics revealed total nonfarm payroll increased by 114,000. This report came in much lower than economists’ predictions of 185,000. Meanwhile, the unemployment rate rose to 4.3%, the highest level since October 2021.

Federal Reserve officials again left interest rates unchanged at between 5.25 percent and 5.5 percent. Fed Chair Jerome Powell stated that rate cuts “could be on the table” in September, but that “we’re not quite at the point” to do this. In its Federal Open Markets Committee statement, the Fed stated that “job gains have moderated, and the unemployment rate has moved up but remains low. Inflation has eased over the past year but remains somewhat elevated. In recent months, there has been some further progress toward the Committee’s 2 percent inflation objective.”

Fear that the Fed may have waited too long to cut interest rates following the July Jobs Report helped contribute to a global sell-off of stocks. On August 5, the S&P 500 dropped 3%, the Dow fell 2.6%, the U.K.’s FTSE 100 index declined 2%, and Japan’s benchmark Nikkei 225 index plummeted 12.4%.

Freddie Mac reported that mortgage rates fell to their lowest level in 15 months. Specifically, the average rate on 30-year mortgages declined to 6.47%. Sam Khater, Freddie Mac’s Chief Economist, stated in a press release that this decline follows “the likely overreaction to a less than favorable employment report and financial market turbulence for an economy that remains on solid footing.”

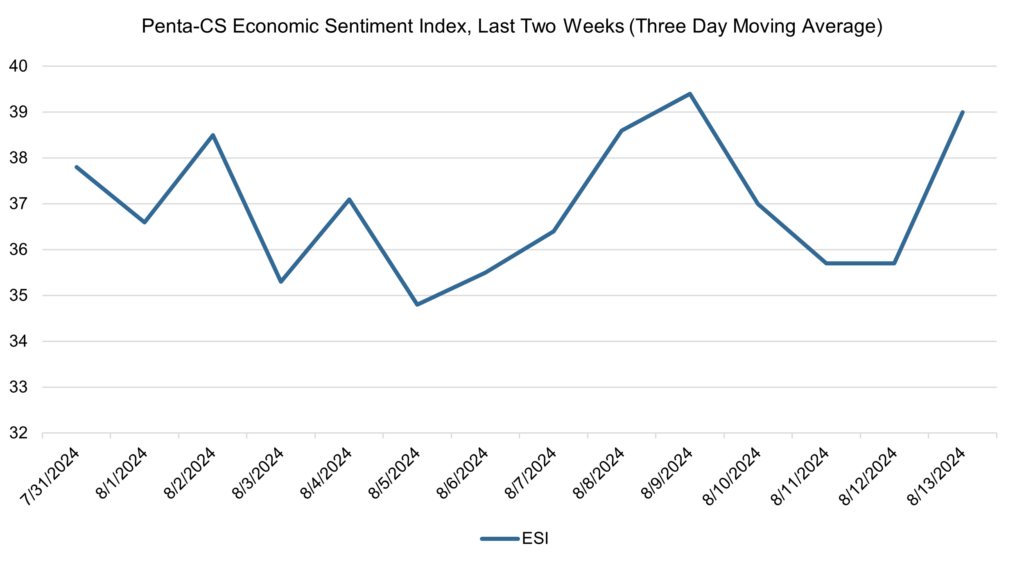

The ESI’s three-day moving average began this two-week period at 37.8 on July 31. It then oscillated before falling to a low of 34.8 on August 5. The three-day moving average then rose back up to a peak of 39.4 on August 9, then decreased back down to 35.7 on August 11 before rising back up to 39.0 on August 13 to close out the session.

The next release of the ESI will be Wednesday, August 28, 2024.